Ad hoc announcement pursuant to Art. 53 LR

- Organic sales growth of 3.9% (of which 3.1% relates to pricing)

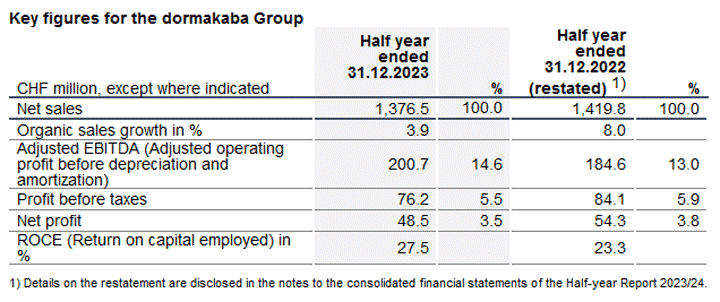

- Adjusted EBITDA increased by 8.7% to CHF 200.7 million (previous year: CHF 184.6 million), with an adjusted EBITDA margin of 14.6% (previous year: 13.0%)

- Net sales of CHF 1,376.5 million (previous year: CHF 1,419.8 million); decrease of 3.0% due to a negative currency translation effect (-6.7%)

- Net profit of CHF 48.5 million (previous year: CHF 54.3 million), including restatement in compliance with the Swiss Accounting and Reporting Recommendations on Consolidated Financial Statements (Swiss GAAP FER 30)

- Cash generated from operations increased due to improvements in net working capital to CHF 146.0 million (previous year CHF 137.6 million)

- Outlook for full financial year 2023/24 unchanged

dormakaba posted organic sales growth of 3.9% in the first half of the financial year 2023/24, in line with guidance and mainly driven by pricing. The adjusted EBITDA margin rose by 160 basis points (bps) to 14.6%. This reflects contributions from both business segments, benefiting from increased operational and procurement efficiencies generated through dormakaba’s transformation program as well as normalizing supply chains and a favorable product mix.

Till Reuter, CEO dormakaba, says: “Our results highlight how everyone at dormakaba contributes to effectively executing our transformation program as planned. We continued to grow organically in line with our guidance, and the significant increase in our margins shows that the expected positive financial effects come to life and that we have progressed on our path towards sustained growth and profitability.”

Net sales, profitability and net profit

Due to a significant negative currency translation effect of CHF 95.2 million, dormakaba’s net sales decreased by 3.0% year-on-year to CHF 1,376.5 million (previous year: CHF 1,419.8 million). Organic sales increased by CHF 51.9 million or 3.9%, driven both by increased sales prices (3.1%) and higher volumes (0.8%).

Adjusted EBITDA, which excludes items affecting comparability, increased by 8.7% to CHF 200.7 million (previous year: CHF 184.6 million). The adjusted EBITDA margin increased by 160 bps to 14.6% (previous year: 13.0%). Positive contributions to margins from increased operational and procurement efficiencies stemming from the Shape4Growth transformation program, combined with good price realization, offset inflationary pressure on semi-finished materials and labor costs. Items affecting comparability totaled CHF -46.6 million at the EBITDA level (previous year: CHF -14.0 million) mainly due to reorganization and restructuring expenses.

dormakaba closed the first half of the financial year 2023/24 with a net profit of CHF 48.5 million (previous year: CHF 54.3 million). The net profit figure reflects a negative impact of CHF 25.0 million from goodwill amortization following the adoption of the revised Swiss GAAP FER 30 accounting standard in financial year 2022/23.

Goodwill was previously offset in equity at the acquisition date; it is now capitalized and amortized in the income statement. The prior period has been restated accordingly.

Cash flow and balance sheet

Cash generated from operations increased to CHF 146.0 million (previous year: CHF 137.6 million) due to tight net working capital management, with particular emphasis on enhancing the efficiency of trade receivables collection. Net cash from operating activities decreased to CHF 89.8 million (previous year: CHF 103.9 million), deriving from higher income taxes and interests paid. Consequently, the operating cash flow margin (net cash from operating activities as a percentage of sales) decreased to 6.5% (previous year: 7.3%). Free cash flow recovered to CHF 63.8 million, above the previous year (CHF 50.1 million).

Net financial debt decreased by CHF 150.2 million to CHF 586.5 million as of 31 December 2023 (previous year: CHF 736.7 million). Financial leverage, defined as net debt relative to reported 12-month rolling adjusted EBITDA, was 1.5x (previous year: 2.0x net debt/adjusted EBITDA).

Performance by business segments

dormakaba saw solid demand in most of its markets during the first half of the financial year 2023/24, with satisfactory order intakes and backlogs.

Access Solutions

The business segment Access Solutions had total net sales of CHF 1,167.1 million in the first half of the financial year 2023/24 (previous year: CHF 1,198.5 million). Segment sales were negatively impacted by currency translation effects (CHF 81.2 million) due to the very strong Swiss Franc. Organic sales growth was CHF 49.8 million (4.5%), driven primarily by good price realization (3.4%). Adjusted EBITDA increased to CHF 177.1 million (previous year: CHF 162.9 million), while the adjusted EBITDA margin increased to 15.2% (previous year: 13.6%); this significant margin improvement was largely due to the positive Shape4Growth measures noted above for the dormakaba Group.

Key & Wall Solutions and OEM

The business segment Key & Wall Solutions and OEM had total net sales of CHF 234.1 million in the first half of this financial year negatively impacted by currency translation effects of CHF 16.6 million (previous year: CHF 252.1 million); organic sales declined by CHF 1.4 million (0.6%) (previous year: +9.0%). Adjusted EBITDA increased to CHF 44.1 million (previous year: CHF 41.8 million) and the adjusted EBITDA margin was 18.8% (previous year: 16.6%). This significant increase was driven by improved margins in the Movable Walls business unit, with margins protected in Key Systems and OEM.

Outlook

Projections for the commercial construction business vary widely between markets, and a persistently challenging macroeconomic and geopolitical environment fosters limited visibility. Despite this uncertainty and due to a good order pipeline and the continued focus on the company’s Shape4Growth transformation execution, dormakaba confirms its guidance for the financial year 2023/24: the company continues to expect organic growth to be in line with its 3-5% mid-term guidance and expects profitability to show sequential improvement above performance in the financial year 2022/23 (13.5%).

The Half-Year Report of dormakaba Holding AG, including consolidated financial statements, is available online at report.dormakaba.com. The analysts‘ presentation is available at dk.world/publications.

Source:

dormakaba Holding AG

dormakaba.com

—

General Disclaimer

This communication contains certain forward-looking statements including, but not limited to, those using the words “believes”, “assumes”, “expects” or formulations of a similar kind. Such forward-looking statements reflect the current judgement of the company, involve risks and uncertainties and are made on the basis of assumptions and expectations that the company believes to be reasonable at this time but may prove to be erroneous. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks, uncertainties and other factors outside of the company’s and the Group’s control which could lead to substantial differences between the actual future results, the financial situation, the development or performance of the company or the Group and those either expressed or implied by such statements. Except as required by applicable law or regulation, the company accepts no obligation to continue to report, update or otherwise review such forward-looking statements or adjust them to new information, or future events or developments.

For definition of alternative performance measures, please refer to the chapter “Notes to the consolidated financial statements” of the Half-year Report 2023/24 of dormakaba.

This communication does not constitute an offer or an invitation for the sale or purchase of securities in any jurisdiction.

dormakaba®, dorma+kaba®, Kaba®, Dorma®, Ilco®, LEGIC®, Silca®, BEST® etc. are registered trademarks of the dormakaba Group. Due to country-specific constraints or marketing considerations, some of the dormakaba Group products and systems may not be available in every market.